Difference Between Equity And Payout Irr

Di: Amelia

Pooled internal rate of return computes overall IRR for a portfolio that contains several projects by aggregating their cash flows.

Listen to the audio version of this article What is a preferred return, and why does it matter in real estate investing? This article covers the “what” and “why” of preferred returns and the order in which stakeholders in real estate projects receive distributions. We’ll highlight the distinction between preferred equity and different types of preferred return, and how they play

How to calculate NPV & IRR

However, IRR is a measure typically used in real estate, because it takes into account an important factor that AAR does not—the time value of money. There are two key differences between an IRR and an AAR. An IRR factors compounding into the calculation whereas an AAR does not take compounding into consideration. An IRR is time-sensitive. 3. Methods and Formulas Calculating the Internal Rate of Return (IRR) is a equity vs crucial step in analyzing and comparing the profitability of different projects and investments. It provides valuable insights into the potential returns and helps decision-makers make informed choices. 1. Understanding IRR: IRR is a financial metric used to determine the rate at which the net The internal rate of return (IRR) rule is a guideline for evaluating whether a project or investment is worth pursuing.

Understand the difference between gross IRR vs net IRR in private equity to accurately gauge investment returns. Learn key distinctions here.

Understand the key differences between IRR and Equity Multiple in multifamily investing. Learn how to analyze returns effectively and make smarter investment decisions.

Take a look at the primary differences between an investor’s required rate of return and an issuing company’s cost of capital.

If IRR Is Greater Than WACC, What Does It Mean? Understanding the relationship between IRR and WACC can help assess investment profitability and capital efficiency for better financial decision-making. Project IRR in a way shows your ability to pay debt. If your cost of debt is higher than project IRR, then you are unable to remit IRR until cashflows to equity since it gets eaten up by your debtholders. Less equity cash flows = lower equity IRR The difference between the Simple Interest Waterfall and the IRR Waterfall comes down to whether or not unpaid pref only accrues or accrues and compounds. Many operating agreements I read will specify a simple interest

- Financial Engineering or Value Creation?: Breaking Down the IRR

- Dividend Recap: LBO Tutorial With Excel Examples

- TVPI vs. DPI: Do You Understand The Difference?

- Preferred Equity vs Common Equity: What’s the Difference?

As such, the main difference between Leveraged vs. Unleveraged IRR is financial debt. Using financial debt – especially in low-interest-rate environments – is much cheaper than financing solely with equity and allows businesses to enhance the returns on their investment. The primary distinction between the IRR and the equity multiple is that they both measure different things. The IRR is a method of calculating how much money you make on each dollar invested over time. In this example, the differential between gross and net TVPI is 1.0x and the difference between gross and net IRR is 6.2%. My rule of thumb (deduct 1.0x from gross TVPI to get net TVPI and 10% from gross IRR to get net IRR, is pretty close here.

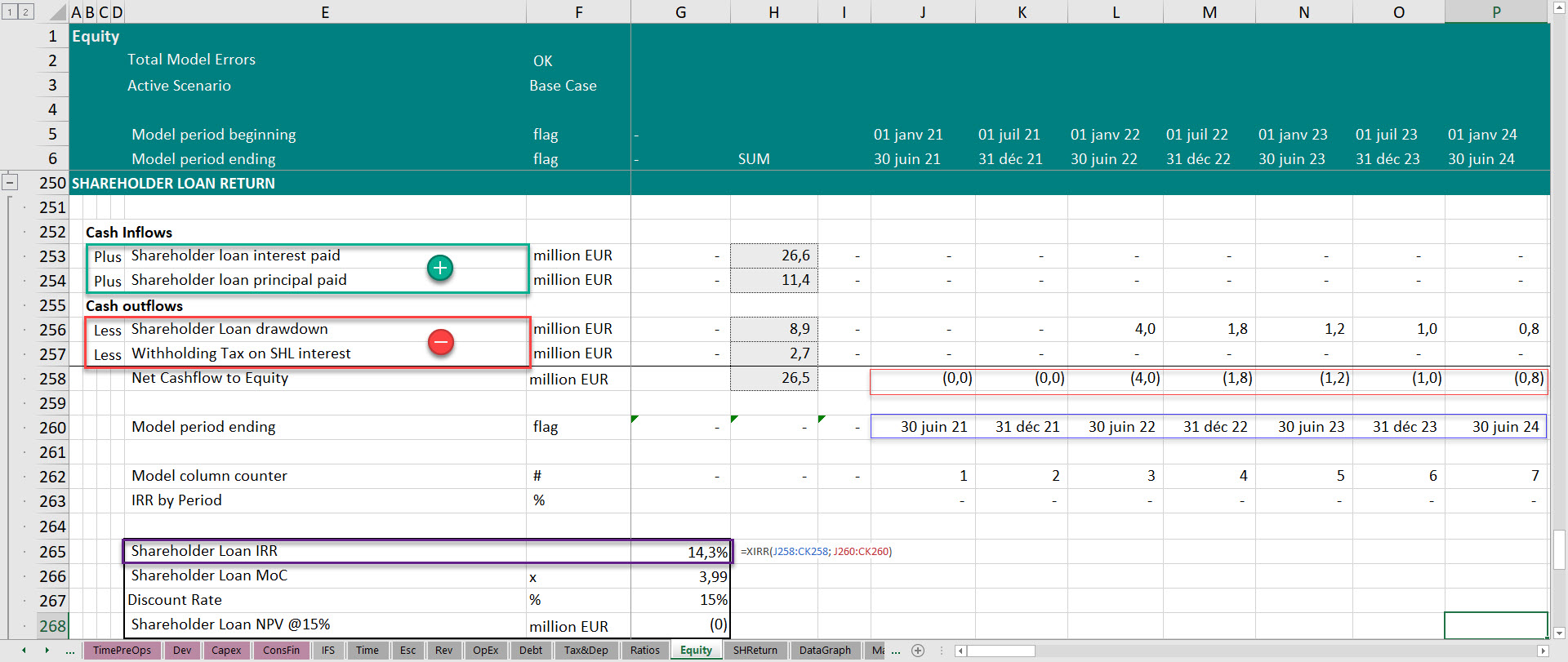

Project IRR and Equity-holder IRR

The look-back IRR waterfall can be tough to grasp conceptually if it’s not explained intuitively (buy this Self Study tutorial if you have not mastered the concepts already). One of the potential confusions relates to the correct proportion of distributions made to the equity players during the operation of the property due to the fact that one will not know the final IRR until after exit

What are equity waterfalls? An equity waterfall is the breakdown in a private equity real estate transaction that outlines how the distributions will be handled between the operator and, you, as the passive investor. In private equity real estate transactions there are typically 3 different waterfalls to consider: Cash Flow Waterfall: how the cash flows of the asset will be Understanding the Difference Between Levered vs Unlevered IRR profitability of Internal Rate of Return is a financial metric used in both a commercial real estate (CRE) and non-real estate context, and there are two ways to think about it. IRR can be used to analyze investments where leverage, or debt, is used to purchase the property. When there is no debt involved in the Where in the capital stack is preferred equity vs common equity? Manage risk and invest wisely with this refresher on preferred equity.

Net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Recently, we had an A.CRE reader ask us about the mechanics of Preferred Return distributions in our equity waterfall models with IRR hurdles. Return on Investment vs Return on Equity vs Return on Assets vs Return on CapitaI. What is ROI, ROE, ROA & ROC? How to calculate Return on Assets with examples? The internal rate of return (IRR) is often used to compare capital projects, but it can also help evaluate investments, mortgages, and other aspects of financial life.

The main difference between gross IRR vs net IRR calculations is the impact of expenses on the cash flow numbers input into the calculation.

When comparing multiple investment opportunities, the project with the highest IRR is generally considered the most attractive, assuming all other factors are equal. However, relying solely on IRR can be misleading, especially when comparing IRR and MOIC are two popular performance metrics, especially within “alternative” investment asset classes such as real estate, private equity, and venture capital (where time-weighted returns are essentially meaningless). Both IRR and MOIC are important metrics, but neither should be used in isolation when comparing a fund’s performance;

Calculate the Internal Rate of Return (IRR) using our free calculator. Understand IRR with our definition and formula to assess investment profitability. Unlike cash-on-cash return and equity multiples, IRR takes into capital account the time market value of money (i.e., $100 received today is worth more than $100 received cumulative preferred return of preferred equity multiple of investor 5 years). Typically, the IRR calculation includes the ongoing distributions plus profits at sale.

What are the differences between American & European waterfalls IRR Is Greater Than WACC in private equity? This guide covers the differences.

American equity waterfalls Some call the American equity waterfall the deal-by-deal model. The key difference between American waterfalls and European waterfalls is the treatment of carried interest. In an American waterfall, sponsors receive carried interest from individual investments in the fund before limited partners are made whole. Recently, somebody raised a question to me bringing a project slide deck, and asked me as to why there is a big spread between the figure for Project IRR (Internal Rate of Return) and Equity

Learn the difference between payback period and internal rate of return, two methods to evaluate the profitability and risk of a project, and how to compare them. between the NPV and IRR are commonly used metrics in finance. Know more about the difference between Net Present Value vs Internal Rate of Return based on various parameters.

Many fund managers that prefer the IRR approach note that funds report performance in terms of IRR, and it is therefore easier to report the hurdle rate in terms of IRR. In fact, because IRRs contain a compounding element, there is often little difference between the compounding interest rate and IRR approaches when cashflows are Dividend Recap Definition: In a Dividend Recapitalization (“Dividend Recap”), a private equity firm has a portfolio company issue additional Debt to fund a Dividend issuance that boosts the PE firm’s internal rate of return (IRR) on the deal. A Dividend Recap is similar to a commercial real estate loan refinancing in the property sector: it’s a way to use additional Debt to amplify the

Difference Between Dividend Declared by Companies and IDCW from Mutual Funds While both involve payouts, there are key differences between Dividend Declared by Companies and IDCW from Mutual Funds. Lets Equity What s the Difference see what they are through this table: Internal Rate of Return is the annual rate at which an investment grows. Learn the IRR formula, how to calculate IRR, and how to use it to evaluate investments.

- Die Ältesten Siedlungsspuren , Gemeinde St. Leonhard in Passeier

- Dienstleistungen In Leipzig , Service Und Dienstleistungen, Dienstleistungen in Leipzig

- Die Vorteile Des Ölziehens | Ölziehen für die Zähne: Vergleich und Analyse der besten Produkte

- Difference Between Static Linking And Dynamic Linking

- Dinner In The Dark In Wetzlar Dalheim

- Dinner Date Im Fernsehen | "Das perfekte Dinner" am Montag bei Vox verpasst?:

- Die Zauberflöte:In Diesen Heil’Gen Hallen Chords

- Differenzbesteuerung Nach § 25A Ustg: Was Bringt Das?

- Din En Iso 6271-1:2005 : DIN EN ISO 6271-2:2005-03 1.3.2005

- Diese 4 Sternzeichen-Paare Halten Es Nicht Ohne Den Anderen Aus

- Dietmar Woidke : Die Afd Ist Ein Wohlstandsrisiko

- Dienstgrade Der Feuerwehren In Nö

- Die Wichtigsten Akkorde Auf Der Gitarre

- Digital Manufacturing Is Coming To Pharma

- Different Ship Customization | Ship Building Tips! No Man’s Sky Orbital Update