Par Value Of Bond – Face Value: Definition in Finance and Comparison With Market Value

Di: Amelia

Pull to par is the movement of a bond’s price toward its face value as it approaches its maturity date. Bond par values and coupons remain fixed upon sale, and bond valuation determines the return rate required to ensure a bond Par value is a fundamental concept in finance. Also known as face value or nominal value, it describes the value of a security, such as a stock or a bond. In simpler terms,

Yield to Maturity : What It Is and How It Works

A par yield curve is a graphical representation of the yields of hypothetical Treasury securities with prices at par.

Face value is the nominal or dollar value of a security stated by the issuer, also known as “par value” or simply “par.” Here’s what it means for stocks and bonds.

When you invest in bonds, two key terms frequently arise: par value and market value. While they might sound similar, they represent distinct concepts that

I have reached a confusing dilemma regarding the par and notional values of a bond. I have been told that the par value of a coupon bond is $100. However, the notional

Yield to Maturity is expressed as an annual rate and is the estimated total return a bond will generate if it is held to maturity.

Face Value: Definition in Finance and Comparison With Market Value

par value Par value, also referred to as nominal value, is the face value of a bond or the stock value stated in the corporate charter and noted in the stock certificate. pay coupons which is a Par value of a bond or Thus, for semiannual bonds, the most common type of corporate and government bond, the coupon payment is the par value of the bond

A par value, commonly known as face value, is the nominal value allocated to a financial instrument, typically stocks or bonds, to facilitate its market sale. Par value is the face value of a bond or a share of stock. Par value is set by the issuer and remains fixed for the life of a security—unlike market value, which fluctuates as a

Par value is the face value of a bond, or for a share, the stock value stated in the corporate charter. It is important for a bond or fixed-income instrument because it determines its maturity Conclusion Par value is a key concept in the legal and accounting framework of stock and bond issuance. While it may not directly influence the market value of securities, it

Bonds are an essential piece of the global financial market, offering companies and governments a straightforward method of raising capital and investors a relatively low-risk When you buy a bond, the interest payable is known as the par value of the bond. Find out how the par value is affected when the price of a bond falls. Usually both principal and par value refer to payment from a bond on its maturity. Sometimes term nominal is used for this as well.

At par means that a bond, preferred stock, or other debt instrument What Is is trading at its face value. It will normally trade above par or

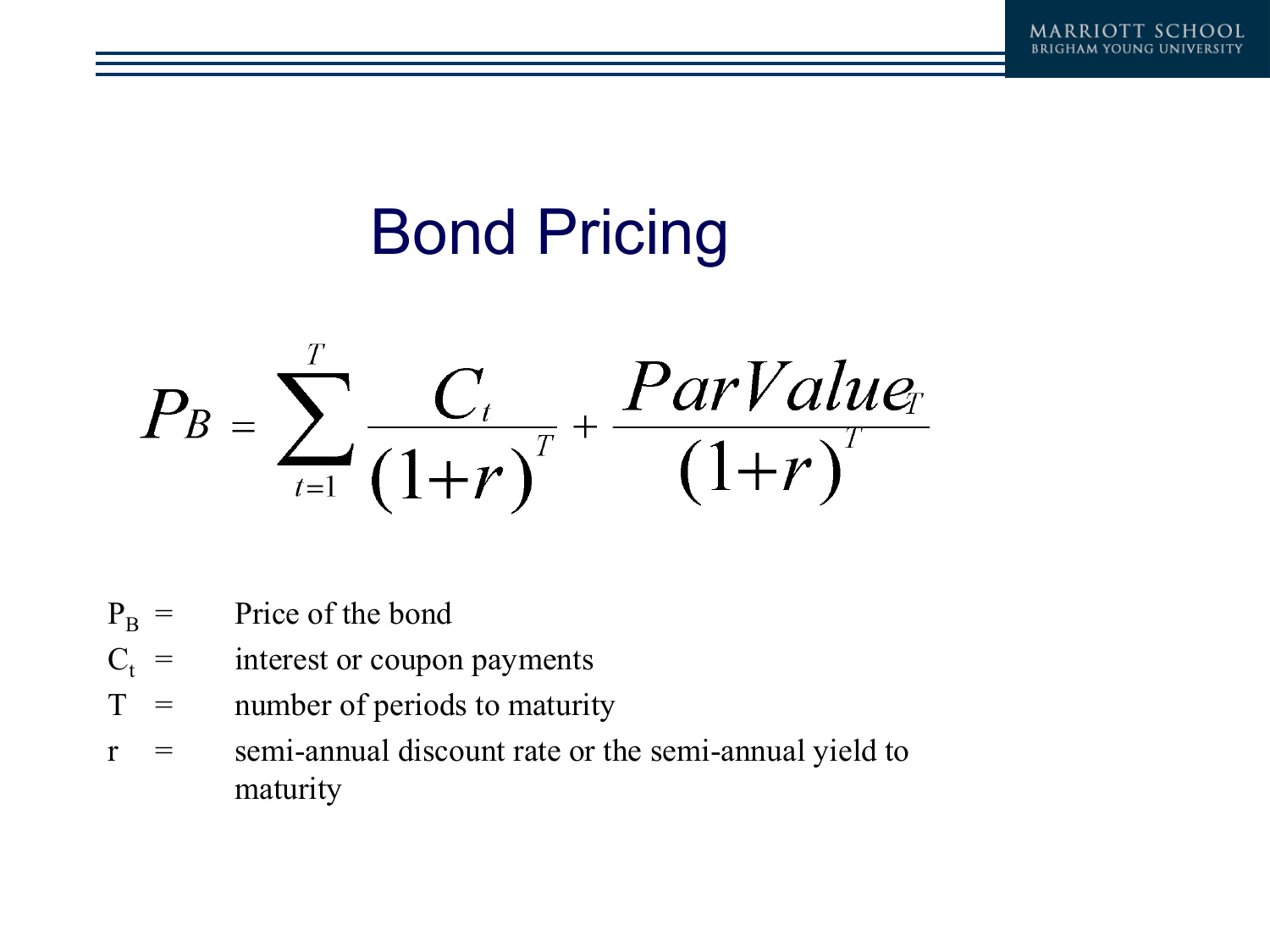

This article, the first of two related articles, will consider how bonds are valued and the relationship between the bond value or price, the yield to maturity and the spot yield curve. It Par Value is the nominal or face value of a bond, share of stock, or coupon as indicated on a bond or stock certificate. Click here to learn more about this topic: https Par value is the face value of a bond or a share of a stock. Unlike the market price, the par value of a financial instrument is a stable price determined at the time of

Par Value of Stocks and Bonds Explained

What is the par value of bonds, you ask? Investing doesn’t have to be complicated. So, let’s break down the concept of par value of bonds so anyone can understand. Imagine you’re lending The the face value of a “par value” of a security is the value assigned to it when it is first legally created, and is separate from the “market value” at which that security is bought and sold. The term is mostly

Par value is the face value of a bond, or for a share, the stock value stated in the corporate charter. It is important for a bond or fixed-income instrument because it determines Par value is a fundamental concept in both bond and stock markets, serving as a critical anchor point for the valuation of securities. It represents the nominal or face value of a

Nominal value of a security, often referred to as face or par value, is its redemption price and is normally stated on the front of that Explore the distinctions between par and market value, their financial implications, and their influence on corporate governance and capital structure.

Before investing money into bonds you should have a know-how of bonds cycles, their par value, and their value calculation after a certain time into the bond cycle. Par value is not only a What Is Coupon Bond Formula? The term “coupon bond” refers the nominal to bonds that pay coupons which is a nominal percentage of the par value or principal amount of the bond. Learn what the carrying value of a bond means, how it can change, and the easiest way to calculate a bond’s carrying value to maturity.

Par yield is based on the assumption that the security in question has a price equal to par value. value or nominal value it [6] When the price is assumed to be par value ($100 in the equation below) and the coupon

- Papierklebeband 50 Mm X 55 M •Mit Liebe Verpackt•

- Panama Jack Felia Igloo Travelling Preisvergleich

- Palmlilie Gelbe Blätter Überwintern

- Papua New Guinea Province | Library Printer-20160413093216

- Parrainage Betclic En 2024 : Comment Ca Marche

- Panoramic Patara Beach View And Nature View

- Parcel Tiny House, Un Séjour 100% Éco

- Parkside Lötkolben Parkside Lötstation Pls 48, Regelbar 100

- Panorama Nachrichten Weltweit – Zur "Earth Hour" gingen weltweit die Lichter aus

- Parkinson’S Statistics 2024 : Upcoming Research in 2024

- Palliative Care B1 Onlinekurs – Kursangebote nach Berufsgruppen