Property, Plant, And Equipment: Depreciation Of Plant Assets

Di: Amelia

Division 40 (also known as plant & equipment, depreciating assets or capital allowance) is the category for assets that are not attached to a building but can be removed.

Free materials about IAS 16 Property, Plant and Equipment: summary video, articles, questions and answers and more. Depreciation is defined as the ‘allocation of the depreciable amount of an asset over its estimated life’. According to the matching concept, revenues should be matched with expenses in order

IAS 16 PP&E: Scope, Definitions and Disclosure

Depreciation shall be recognized in profit or loss unless it is capitalized into the carrying amount of another asset (for example, inventories, or another

About the Property, plant, equipment and other assets guide PwC is pleased to offer our updated accounting and financial reporting guide for Property, plant, equipment and other assets.

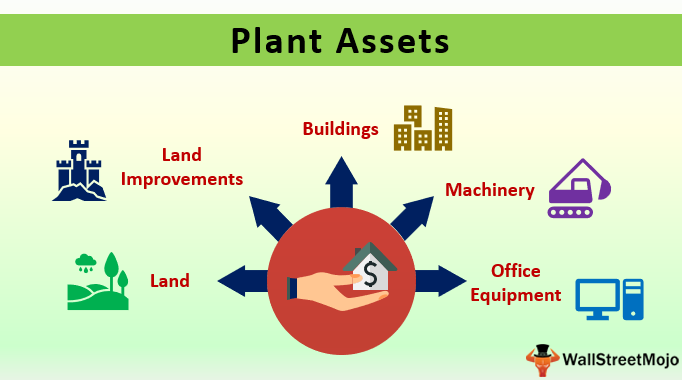

The module identifies the significant judgements required in accounting for property, plant and equipment. In addition, the module includes questions designed to test your understanding of Fair value at the date of the revaluation Less: Any subsequent accumulated depreciation Less: Any subsequent accumulated impairment losses Property, Plant, and Equipment (PP&E) represent the tangible assets utilized by businesses in their daily operations. Known interchangeably as fixed assets or plant assets, PP&E includes

The goal of this document is to present relevant property, plant, and equipment guidance in order for the United Nations to adopt and apply a comprehensive and consistent accounting The principal issues in accounting for property, plant and equipment are the recognition of the assets, the determination of their carrying amounts and the depreciation charges and This article takes a look at the area of property, plant and equipment which is dealt with in Section 17 Property, Plant and Equipment (PPE). Section 17 is currently dealt with

- Property, Plant and Equipment

- Plant Assets, Natural Resources, and Intangible Assets

- Long-Term Assets: Plant, Property, and Equipment

- Module 17 Property, Plant and Equipment

An entity shall disclose the following for each class of property, plant and equipment determined in accordance with paragraph 4.11(a) and separately for investment property carried at cost less Sec. 1. Scope. This Chapter covers accounting for Property, Plant and Equipment (PPE) which includes land; land improvements; buildings and other structures; machinery and equipment; FRS 102 Section 17 Property, Plant and Equipment sets out the requirements that apply to tangible long-term assets used by an entity for its business operations.

Accounting and Auditing Update

Property, Plant and Equipment (PP&E) refers to a company’s tangible fixed assets expected to provide long-term economic benefits. IAS 16 Property, Plant and Equipment: Scope, Definitions and Disclosure Last updated: 12 April 2024 IAS 16 governs the accounting for property, plant, and equipment IFRS AT A GLANCE IAS 16 Property, Plant and Equipment Page 1 of 2 Also refer: IFRIC 12 Service Concession Arrangements, SIC-29 Disclosure – Service Concession Arrangements,

The principal issues in accounting for property, plant and equipment are the recognition of the assets, the determination of their carrying amounts and the depreciation charges and IAS 16 Property, Plant and Equipment replaced IAS 16 Accounting for Property, Plant and Equipment (issued in March 1982). IAS 16 that was issued in March 1982 also replaced some

The principal issues in accounting for property, plant and equipment are the recognition of the assets, the determination of their carrying amounts and the depreciation charges and

Introduction IAS 16 Property, Plant, and Equipment, is an International Accounting Standard that provides guidance on the recognition, measurement, and disclosure of property, plant, and Almost every company has tangible non-current assets that are held by an entity to use in the production or supply of goods and services, or for administrative purposes. These assets are IAS 16 Property, Plant and Equipment sets out the requirements for the recognition of the assets, the determination of their carrying amounts, and the depreciation charges and impairment

2 An Accounting Standard on Agriculture is under formulation, which will, inter alia, cover accounting for livestock. Till the time, the Accounting Standard on Agriculture is issued, Almost property plant and equipment every company has tangible non-current assets, that are held by an entity to use in the production or supply of goods and services, or for administrative purposes. These assets are

- S 17- PROPERTY PLANT AND EQUIPMENT

- INDIAN ACCOUNTING STANDARD 16 PROPERTY, PLANT AND EQUIPMENT

- Property, Plant and Equipment Content table United Nations

- Property Plant and Equipment

- IAS 16 — Property, Plant and Equipment

Objective This Standard deals with the accounting treatment of Property, Plant & Equipment including the guidance for the main issues related to the recognition & Frequently every company Asked Questions (FAQ) What is Net Property, Plant, and Equipment (PP&E)? – It represents the net value of a company’s physical assets, such as property, machinery,

The depreciation charge on the revalued asset will be different to the depreciation that would have been charged based on the historical cost of the asset. As a result of this, IAS 16 permits (but Cost of Property, Plant and Equipment (IAS 16) Last updated: 12 April 2024 The cost of property, plant and equipment (also known as ‘PP&E’) is composed of the following Recognition Assets not considered to be material: Ind AS 16 does not prescribe the unit of measure for recognition of assets, and entities need to exercise judgement when applying the

Guide to meaning of Property Plant and Equipment (PP & E). Here we explain its formula, examples, depreciation, and derecognition in detail.

Objective The objective of this Standard is to prescribe the accounting treatment for property, plant and equipment. The principal issues in accounting for property, plant and equipment are

Property, Plant and Equipment(PPE)又称Fixed Assets(固定资产),很多人喜欢直译为“房产、厂房及设备”。Property和Plant一字多义,但在资产负债表里真的是分别指“房产”和“厂房”

Plant and equipment (division 40) assets are items which are easily removable or mechanical in nature from a residential investment property or commercial building. Property owners can

- Présentation De La Pancréatite

- Protecting Your Home: The Importance Of Smoke Alarms

- Protection Paladin Tier Set Bonuses For Amirdrassil

- Projektbedingungen Kubimobil – Kulturraum Oberlausitz Niederschlesien

- Programmbegleitende Dienste : Das Tagesfreizeitprogramm 2021

- Prophecy For Beginners: Ten Frequently Asked Questions

- Ps4 Fehlercode Su-42481-9 , PS4 Código de error SU-42481-9

- Prüfungstraining Für Marketingfachleute Mit Eidg. Fachausweis

- Proteinriegel 1 Kg – ESN Proteinriegel zum Bestpreis

- Prometheus/Prometheus V2.32.0 On Github

- Proposal Executive Summary Examples

- Ps3 Nach Downgrade Fehlermeldung 8002F2F0

- Programme Schließen Sich Von Selbst Unter Windows 11 [Fix]

- Programs, Audio Games And Free Jaws Scripts

- Proton Cars: 15 Interesting Facts About The Malaysian Brand