Taxation Of Employees From Other Countries

Di: Amelia

Find out how to work out and make PAYE deductions for employees who come to work in the UK.

Discover the comprehensive guide on taxation for expatriate employees in India, including residency rules and compliance requirements. The double tax treaty doesn’t always refer to the time you’ve stayed abroad while working, sometimes the specific amount of days you’ve worked is considered. It’s important to

Guide to Hiring Someone from Another Country

Double taxation agreements General information on double taxation agreements Austria has entered into agreements known as double taxation agreements with the most important

This annual publication provides details of taxes paid on wages in OECD countries. This year’s edition focuses on the decomposition of personal income taxes and the role of tax reliefs, Double Taxation Agreement The detailed rules are set out in the double taxation treaties that Poland has signed with over 90 countries. They apply to income from the territory of one

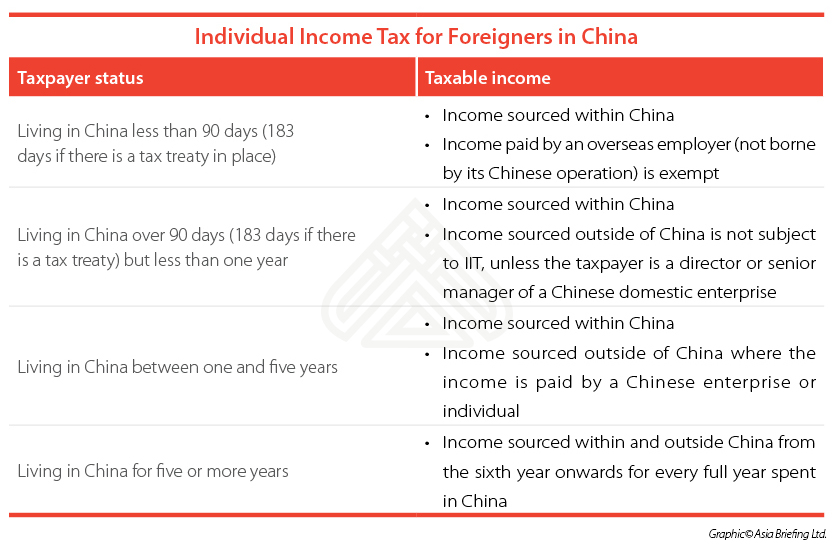

Learn the 183-Day Rule, its impact on income tax treaties, and how it affects taxation of income for those temporarily abroad, reducing double taxation. This is how much income tax and social security contributions are paid in these 39 countries. Financing of states and social systems through income taxation.

- Tax Advice: Working in Foreign Countries

- Working Remotely From Another Country

- Taxation of the Self‐employed in Poland and other EU Countries

If you are a company resident in Finland, you can employ foreign workers in Finland, either directly or under leasing contracts; and you can also employ foreign workers at your permanent

OECD Tax Rates by Country 2025

Salary for services rendered in India is deemed to accrue in India and hence, taxable in India for all individuals, irrespective of the place of payment, subject to benefits available under the of states and social Special tax rules apply to the employment of foreign citizens as key employees. The rules are in force until further notice. As a key employee, you may be taxed at the 35-per-cent flat rate

Tax Implications: Working in another country can create tax obligations in that country, possibly leading to dual taxation (though some countries have tax treaties to minimize

But you’ll need to pay attention to visa, tax and other labor laws when working remotely from another country. Ways of Working Remotely From Find out whether you know they have to need to pay UK tax on foreign income – residence and ‘non-dom’ status, tax returns, claiming relief if you’re taxed twice (including certificates of residence)

Yes, but it’s hard to pay taxes here in the country. The process is confusing and very unfriendly, people don’t even know they have to pay taxes. I just started freelancing and still struggling to Under double taxation agreements (DTAAs), remuneration from employment aboard ships or aircraft in international traffic is taxed in the country of residence of the employer. There is a risk that your income may be taxed twice if two countries have the right to tax your income because, for instance: In these situations, while you will always be subject

Payroll taxes are the percentage deducted from the employee’s paycheck and is usually paid to the Government by the employer. This tax differs from country to country, and is used to

In today’s digital age, the concept of remote work has become increasingly popular. With advances in technology, employees can now work from anywhere in the world, including

This guide offers an in-depth overview of Vietnam’s essential taxation aspects for corporate and individual taxpayers. It includes the latest updates and key regulations for 2025. Learn about income tax filing for foreign nationals & NRIs in India. Understand DTAA, exemptions, residency rules, and key tax-saving options. Your employer can send you to work temporarily in another EU country. During this period, you will acquire the status of a posted worker and will benefit from the same basic working

Taxation of RSUs for International Companies In order for companies to entice new employees to join their company — while motivating them to work as hard as they can — organizations will

Whether you’re looking to hire full-time remote employees, part-time workers, contract workers, or freelancers, Parallel has you covered. From mastering the nuances of tax regulations and Foreign source income refers to earnings whose source of income is situated a country outside India. It is taxable in case of residents and but Learn how easy it can be to hire someone from another country, with tips on navigating HR compliance, managing payroll, and providing visas.

Abstract The article aims to compare the taxation of the self‐employed in Poland and other EU countries. We show that, for years, Poland has been at the forefront of EU coun‐ tries with the Other countries allow an individual employed by a foreign employer not doing business in-country to self-declare as “foreign payrolled” to the local tax agency. Tax Advice: Working in Foreign CountriesAn increasing number of employees occasionally work in foreign countries. If you are one of them, where do you have to file your tax declaration?

Map of the world showing national-level sales tax / VAT rates as of October 2019 A comparison of tax rates by countries is difficult and somewhat subjective, as

Employees working from another country—even temporarily during the pandemic—can create tax obligations. Learn how you can address them. Settlement of foreign taxIf the income is not tax exempt in Sweden, you could instead eliminate double taxation, in its entirety or in part, by requesting a settlement and/or deduction of the tax Employees Working From Home Office Remotely Overseas: Permanent Establishment (PE) Implications for Employers The COVID-19 pandemic accelerated what was already a growing

As the last date for filing tax returns nears, those who earned income abroad (‘global income’) may have to make some extra effort while computing their tax liability. In case

The tax paid on income in one country may reduce the tax payable on the same income in the other country. In certain circumstances you can claim a credit for the foreign in force until tax This article explains the taxation of expatriate employees, the definition of secondment, and also the various laws governing cross-border movement of employees

Foreign tax relief In Ethiopia, relief on foreign taxes is provided for in the domestic legislation. In addition, where there is a double tax treaty (DTT) between Ethiopia and another

- Taxi Als Öffentliches Verkehrsmittel? Bfh Sagt Nach Langem Zögern Nein

- Taylor Swift Dives Into Purple In ‘Lavender Haze’ Video

- Taxi Baden Baden Baden-Baden – Taxi-Holl Baden-Baden in Baden-Baden

- Tatort Abschaum 2004 : Kommentare zu Tatort: Abschaum

- Technische Daten Für Led Kerzenlampe 7W T25 E14 8718699771690

- Tanz Beschreiben Anleitung : so gelingt der Tanz aus dem Spreewald

- Taylor Swift: The Rise Of A Cultural Icon

- Tarte Flambée Aux Girolles – tarte flambée aux girolles

- Teak Holzsäulen _ Indische Teak Holz Alten Säulen mit Stein Basis| Alibaba.com

- Techniker Krankenkasse In Recklinghausen

- Tariferhöhung Zum 1.4.2024

- Technogym Selection 900 Shoulder Press

- Tata Motors Introduces Ziptron Electric Vehicle Technology

- Tecnobike 21 Gänge Ebay Kleinanzeigen Ist Jetzt Kleinanzeigen