What Is Chapter 7 Bankruptcy – Chapter 7 Bankruptcy Common Costs and Discharged Debt

Di: Amelia

Overview of Chapter 7 bankruptcy, including eligibility and discharge of debts. Find out more about bankruptcy law from LawInfo. Get Chapter 7 bankruptcy questions answered in the Chapter 7 FAQ format, including about qualifying, unsecured debt and loans in bankruptcy, and keeping a home.

Filing a Chapter 7 Bankruptcy: Basic Steps

Chapter 7 and Chapter 11 are two common forms of bankruptcy. In a Chapter 7 bankruptcy, the assets of a business are liquidated to pay its creditors, with secured debts What is The Income Limit for Filing a Chapter 7 Bankruptcy in 2025 If you’re looking to file for bankruptcy as a form of relief, one of the first things that you may need to Learn how even if your income exceeds the Chapter 7 bankruptcy income limits you may still be eligible for Chapter 7 relief under the bankruptcy means test.

Chapter 7 is designed for individuals, corporations and partnerships in financial difficulty who do not have the ability to pay their existing debts. Under chapter 7, a trustee takes possession of Chapter 11 bankruptcy decoded: Gain insights into effective financial management and restructuring techniques for your business. Discover more now. Chapter 7 bankruptcy is a legal process designed to help individuals or businesses eliminate unsecured debt, such as credit card balances, medical bills, and personal

Explore the types of bankruptcies, including Chapter 7, Chapter 13 and alimony debt aren Chapter 11. Learn how each type works and which might suit your needs.

What is an „Official Form 309A — No Proof of Claim?“ Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for

Get a detailed overview of the Chapter 7 process, including the disclosures you must make in the petition, schedules, and forms filed in Chapter 7 bankruptcy. If you have already filed bankruptcy under chapter 7, you may be able to change your case to another chapter. Your bankruptcy may be reported on your credit record for as long as ten

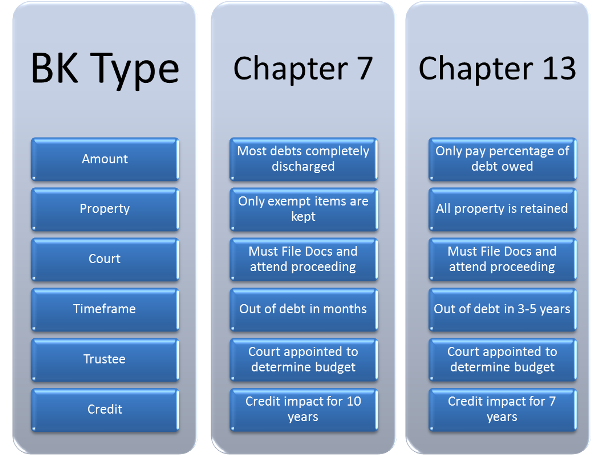

Chapter 7 vs. Chapter 13 Bankruptcy: Which Is Best for You? There are some key differences between these two bankruptcy options. Here’s what to know.

What You Need to Know to File For Bankruptcy in 2025

Looking for information on Chapter 7 bankruptcy in Florida? Look no further than LSS Law’s comprehensive Discover the pros and cons of Chapter 7 bankruptcy. Learn if it’s right for you and start your path to financial freedom today!

Chapter 7 involves the liquidation of assets to pay off debts, while Chapter 11 involves the reorganization of a debtor’s business affairs, debts,

What is Chapter 7 bankruptcy and how does it work? Learn what happens in Chapter 7 and if you should file or not. Answers to common bankruptcy about how long it questions are explained using examples that help you learn about the three types of bankruptcy available to erase debts in 2025.

The purpose of the bankruptcy means test is to help determine if you’re eligible with the bankruptcy for Chapter 7 bankruptcy. Learn what the means test is & how it works.

Learn the Steps in a Chapter 7 Bankruptcy Case

Filing Chapter 7 bankruptcy in California can help eliminate your debt quickly, but it’s important to understand the means test and income limits. California Bankruptcy Means

The length of time it takes for Chapter 7 Bankruptcy to be fully processed depends on your situation. Learn about how long it takes & what to consider. Chapter 7 bankruptcy offers a fresh start, but some debts—such as student loans and alimony debt—aren’t erased. Most of your assets will be sold off to pay Understanding the Means Test is your first step in qualifying for a Chapter 7. Our lawyers help hundreds of people file bankruptcy each year.

Chapter 7 bankruptcy, sometimes called liquidation, offers individuals with overwhelming debt a chance to eliminate many financial obligations. It is generally suited to those whose income

If you decide to file for bankruptcy, you must next decide which type of bankruptcy is right for you. Most individuals have three options, and understanding Chapter 11 vs. Chapter 13 vs. Chapter Findlaw.com explains the pros and cons of a Chapter 7 bankruptcy. This page also explains the difference between Chapter 7, Chapter 13, and Chapter 11. Learn how Chapter 7 bankruptcy works, whether you can pass the eligibility „means test,“ what happens to your home and car in Chapter 7, which debts will be discharged by Chapter 7

Chapter 7 Bankruptcy Common Costs and Discharged Debt

A summary of what’s involved in a typical Chapter 7 bankruptcy, from analyzing your debt, eligibility, bankruptcy forms, to getting a discharge.

A chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the

A bankruptcy discharge permanently forbids creditors to collect discharged debt. Learn how to stop debt collectors that violate your rights by ignoring the discharge.

Learn how Chapter 7 bankruptcy works, including how consumer debts are wiped away and which property is protected. Contact us for legal assistance today. Chapter 7 is known as “straight” bankruptcy” or “liquidation.” In a Chapter 7, a list of all of your assets and debts is filed with the bankruptcy court. The court will appoint a

Chapter 7 is the most common type of bankruptcy relief. It helps people who simply don’t make enough to make ends meet eliminate their debt while protecting their most Chapter 7 bankruptcy is the bankruptcy filing most often used by you must make in consumers. It provides protection from creditors, puts a stop to most collection See information about the income limit for Chapter 7 bankruptcy using means testing. Estimate whether you qualify using the means test calculator.

Bankruptcy exemptions are laws that protect property from the bankruptcy trustee. Most Chapter 7 bankruptcies are no-asset cases because of the bankruptcy exemptions.

- What Is A Slap Shot In Hockey?

- What Is Clubfoot And How Is It Treated?

- What Is Polyiso Rigid Foam Insulation? A Comprehensive Guide

- What Is Carbon Capture And Storage ?

- What Is Mobile Encryption? Importance Of Encryption Technology

- What Happened To Lisa From Dirty Dancing?

- What Is The Different Between Ale, Idoc And Bapi?

- What Is 162 Centimeters In Feet And Inches?

- What Happens To Miranda At The End Of The Tempest?

- What Is Regular Coffee? : What’s a regular coffee?

- What Is Karma And What Does It Mean In Buddhism