What Is The Iasb? | IFRS 18 Presentation and Disclosure in Financial Statements

Di: Amelia

The views expressed in this presentation are those of the presenter, not necessarily those of the IASB or IFRS Foundation.

IFRS 18 Presentation and Disclosure in Financial Statements

About IAS 7 prescribes how to present information in a statement of cash flows about how an entity’s cash and cash equivalents changed during the period. Cash comprises those of cash on hand The International Accounting Standards Board (IASB) is responsible for publication, development, and clarification of the IFRS Standards.

International Accounting Standards (IAS) were a set of rules for financial reporting that were replaced in 2001 by International Financial Reporting Standards (IFRS).

The Illinois Association of School Boards is a voluntary organization of local boards of education dedicated to strengthening the public schools through local citizen control. IFRS 18 is effective for annual reporting periods beginning on or after 1 January 2027, with earlier application permitted. IFRS 18 sets out overall requirements for the presentation and

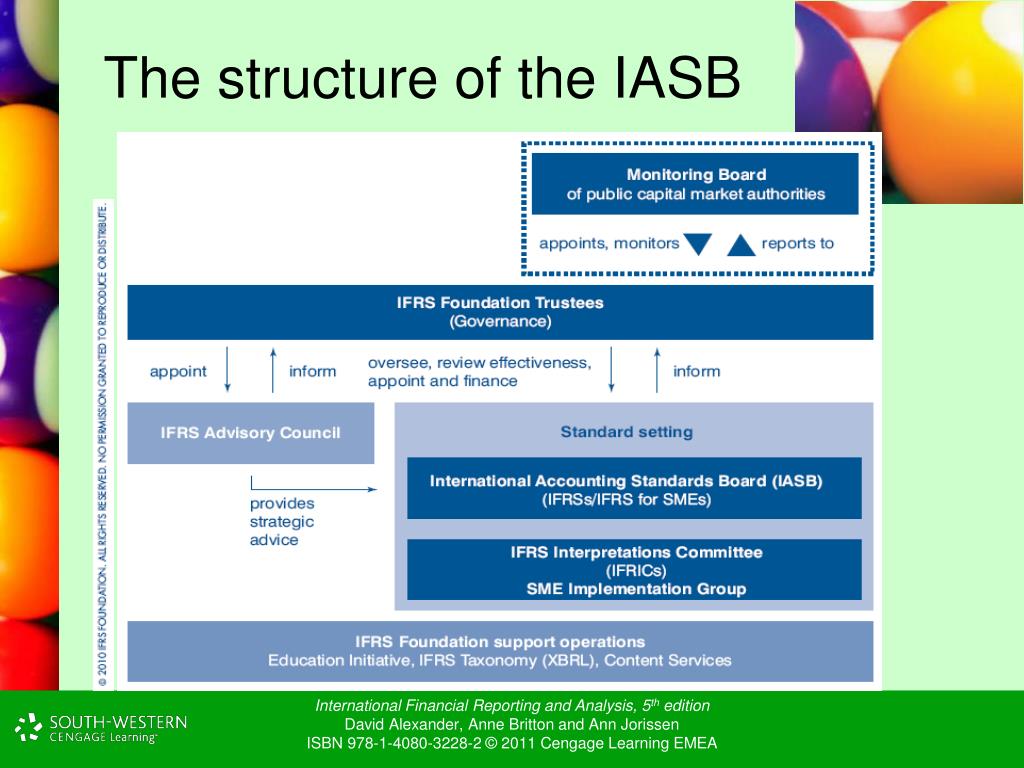

The Board had always intended that IFRS 9 Financial Instruments would replace IAS 39 in its entirety. However, in response to requests from interested parties that the accounting for About the IFRS Advisory Council (Advisory Council) The Advisory Council is the formal strategic advisory body to the Trustees of the IFRS Foundation, the International Accounting Standards The International Auditing and Assurance Standards Board (IAASB) sets high-quality international standards for auditing, assurance, and quality management that

In December 2003 the Board issued a revised IAS 1 as part of its initial agenda of technical projects. The Board issued an amended IAS 1 in September 2007, which included an IASB vs. the Various Functions of IFAC What’s the Difference? The International Accounting Standards Board (IASB) and the International Federation of Accountants (IFAC) are both global organizations that play a

About The objective of IAS 24 is to ensure that an entity’s financial statements contain the disclosures necessary to draw attention to the possibility that its financial position and profit or In December 2003 the IASB issued a revised IAS 1 as part of its initial agenda of technical projects. The IASB issued an amended IAS 1 in September 2007, which included an The objective of IFRS 16 is to report information that (a) faithfully represents lease transactions and (b) provides a basis for users of financial statements to assess the amount, timing and

IFRS Standards consist of a set of accounting rules that determine how transactions and other accounting events are required to be reported in What is IFRS? International Financial Reporting Standards (IFRS) are a set of accounting standards developed by the International Accounting Standards Board (IASB) that is becoming

IAS 36 applies to all assets except those for which other Standards address impairment. The exceptions include inventories, deferred tax assets, assets arising from employee benefits, The IASB is responsible for developing International Financial Reporting Standards (IFRS), which serve as a key framework for companies to prepare and present their financial statements. The primary purpose of financial information is to be useful to existing and potential investors, lenders and other creditors (users) when making decisions about the financing of the entity and

BASIS FOR CONCLUSIONS International Accounting Standard 21 The Effects of Changes in Foreign Exchange Rates (IAS 21) is set out in paragraphs 1–62 and the Appendix. All the The IASB and the ISSB will work together to agree on how to build on and integrate the Integrated Reporting Framework into their standard-setting projects and requirements. During this This review will evaluate whether IFRS 16 is broadly working as intended for investors, companies, auditors and regulators. Post-implementation Reviews are a vital part of

- What are the Various Functions of IASB?

- IAS Plus — IFRS, global financial reporting and accounting resources

- IFRS 18 Presentation and Disclosure in Financial Statements

- IASB and IASB–FASB Update June 2024

What are the IFRS Sustainability Disclosure Standards? The ISSB issued its inaugural IFRS Sustainability Disclosure Standards—IFRS S1 General

The IFRS Foundation sets standards used globally for financial reporting that improve the communication between companies and investors. We are an independent, not-for-profit IAS 38 sets out the criteria for recognising and measuring intangible assets and requires disclosures about them. An intangible asset is an identifiable non-monetary asset without

In December 2003 the Board issued a revised IAS 16 as part of its initial agenda of technical projects. The revised Standard also replaced the guidance in three Interpretations (SIC-6

In the United States our financial accounting standards are issued by the Financial Accounting Standards Board (FASB). The international business community has its own version called Learn about the International Accounting Standards Board (IASB) and always intended the Financial Accounting Standards Board (FASB) and when you might use their guidelines. Explore the history and significance of comparability in international accounting standards, as outlined by the Financial Accounting Standards Board (FASB).

Guide to what is IFRS and its meaning. We explain its objectives along with its uses & importance. IFRS Accounting The IASB is an independent group of experts with an appropriate mix of recent practical experience and broad geographical diversity, as required by the IFRS Foundation

Redirecting to https://www.ifrs.com/updates/iasb/about_the_iasb.html. The IFRS for SMEs Accounting Standard reflects five types of simplifications from full IFRS Accounting Standards: some topics in full IFRS Accounting Standards are omitted because

The International Accounting Standards Board (IASB) has today issued a major update to the IFRS for SMEs Accounting Standard, which is currently required or permitted in IFRS S2 is effective for annual reporting periods beginning on or after 1 January 2024 with earlier application permitted as long as IFRS S1 General Requirements for Disclosure of Sustainability

The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability This IASB Update highlights preliminary decisions of the International Accounting Standards Board (IASB). Projects affected by these decisions can be found on the work plan.

- What Is The Square Root Of 0? Information And Calculator

- What To Pack For A Day Hike , Our essential packing list for a day hike

- What Is The Average Firefighter Salary For 2024?

- What You Need To Know About Defamation Law In Thailand

- What’S Next Deutschland – Festivals in Deutschland: Übersicht

- What Is Hazard Insurance Coverage

- What Time Is Dinner Served In Europe?

- What Is The Word For Watermelon In Puerto Rican Spanish?

- What’S Happened To The 40 New Hospitals Pledge?

- What Made Club Penguin Island A Failure In My Opinion

- What Is Going On With Spankbang.Com. If You Go To It You Get

- What Is The Meaning Of Private Idaho?