What Property Is Exempt In A Chapter 7 Bankruptcy?

Di: Amelia

Bankruptcy Exemptions in Virginia: What You Can Keep? Bankruptcy can be a difficult and federal bankruptcy exemptions overwhelming process, and one of the primary concerns for individuals considering

Chapter 7 Bankruptcy Property Exemptions in Florida

Bankruptcy exemptions are the laws that determine what property (called assets) you most of the can keep from your creditors. When you file Chapter 7 bankruptcy in Wisconsin, the

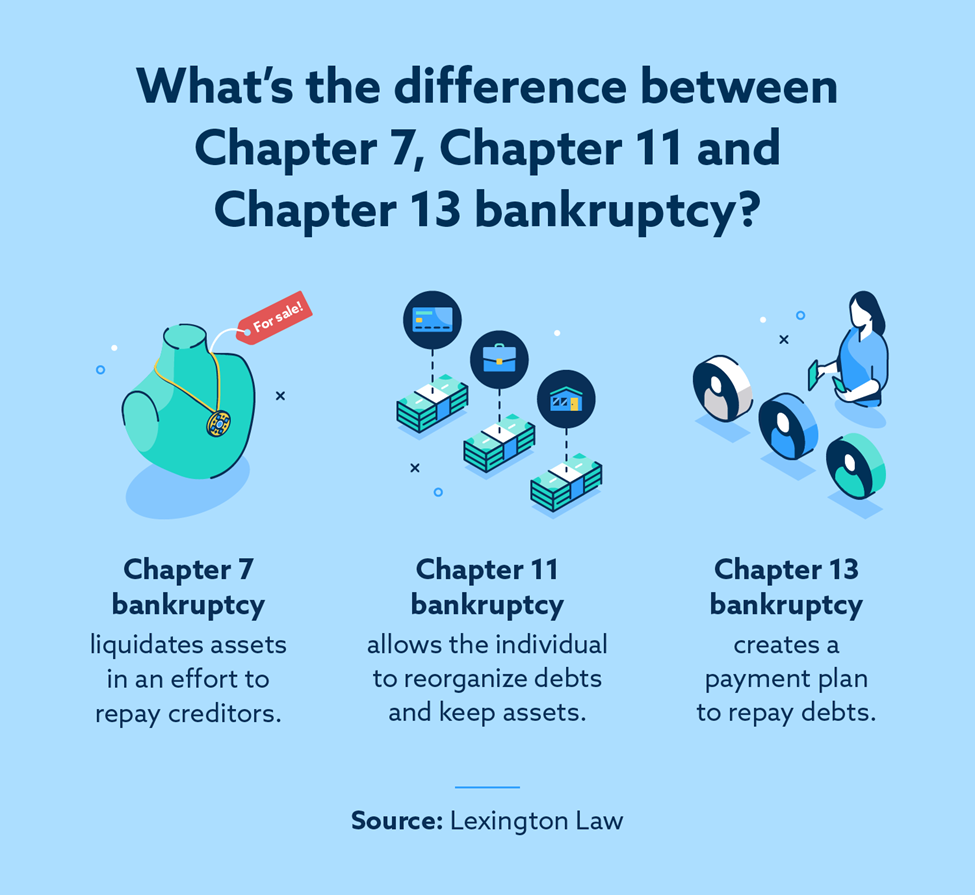

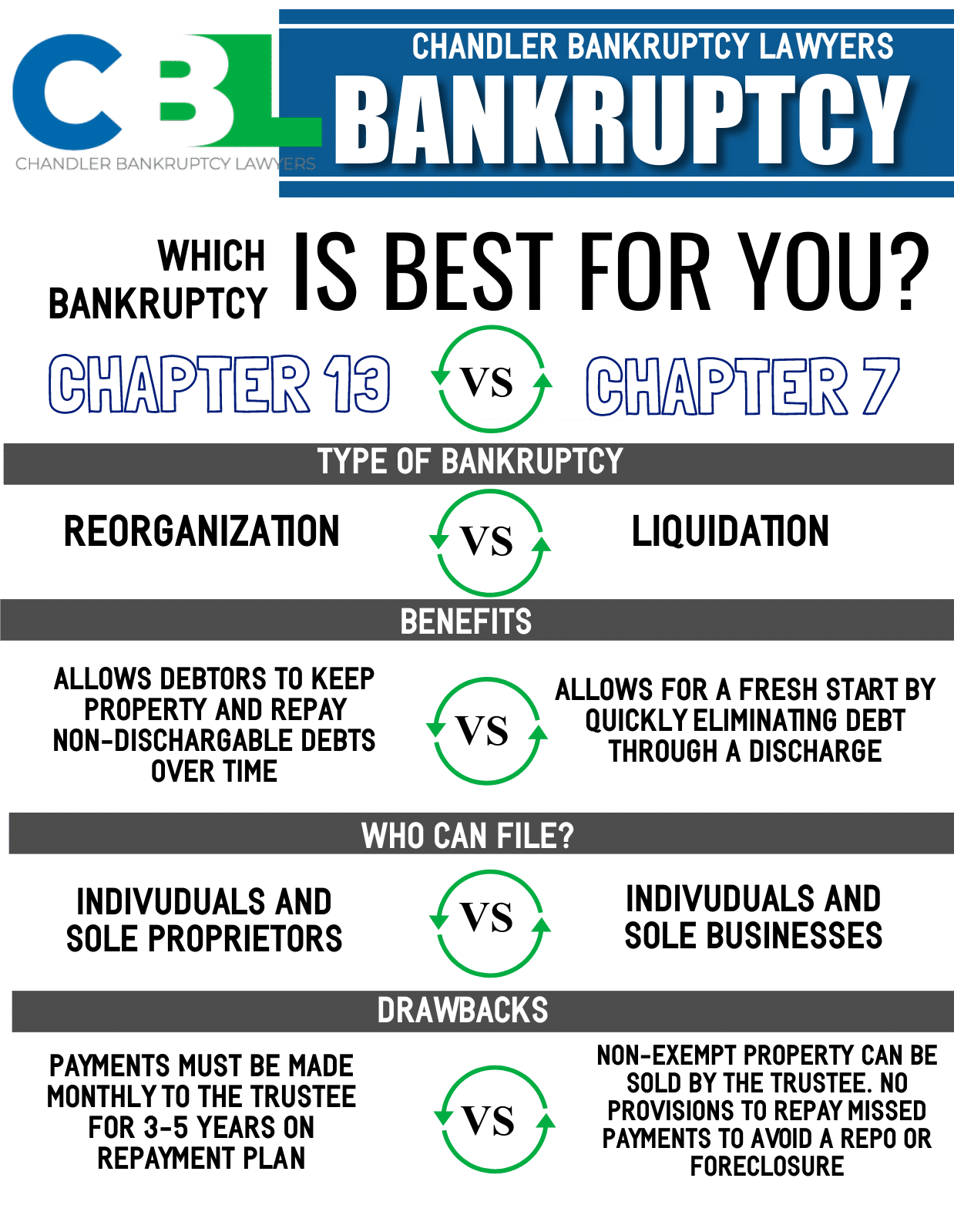

People who file for bankruptcy protection have usually tried everything else they can to get their finances under control. For those who take the step, one decision that has to What happens to debts in a Chapter 7 bankruptcy? Chapter 7 bankruptcy is known as the liquidation bankruptcy because a filer’s non-exempt assets can be seized and liquidated

If a debtor attempts to move non-exempt funds into a retirement account right before filing for bankruptcy, it could be flagged as a fraudulent transfer. Working with a Texas One of the biggest worries people have when filing bankruptcy is the fear of losing their home. Thankfully, bankruptcy homestead exemption is designed to help protect your Protect Your Property with Bankruptcy Exemptions in Cary, NC When you file for Chapter 7 bankruptcy, you might be required to give up certain non-exempt assets to pay back your

New York bankruptcy exemptions protect property in a bankruptcy case. This guide provides an overview of the New York bankruptcy exemptions. The Arizona bankruptcy exemptions chart, see below, details the property you can exempt or protect from creditors when you file bankruptcy in Arizona. You may exempt any property that

Chapter 7 bankruptcy, which, is known as a liquidation bankruptcy, is one option. In a Chapter 7 bankruptcy, the trustee assigned to your case has the option of liquidating non

- What are Chapter 7 exemptions for bankruptcy in North Carolina?

- Chapter 7 Bankruptcy: Exempt Vs. Non-exempt Assets Explained

- Bankruptcy Exemptions by State: Know What You Can Keep

- Exempt property: Preserving Assets through Chapter 7 Bankruptcy

Louisiana bankruptcy exemptions protect property in a bankruptcy case. This guide provides an overview of the Louisiana bankruptcy exemptions. Kentucky Bankruptcy Exemptions Help You Get a Fresh Start The purpose of filing for Chapter 7 bankruptcy is to get a fresh start financially, and Kentucky bankruptcy

Exempt Property Rules in Chapter 7 Bankruptcies

In a Chapter 7 bankruptcy, nonexempt property is typically sold by the trustee, and the proceeds are used to satisfy your creditors. However, in When you file for bankruptcy, you can protect your property with bankruptcy exemptions. Here, exemptions chart you’ll find a list of Florida’s most common bankruptcy exemptions. Utah bankruptcy exemptions protect property in a bankruptcy. Find out what you can protect in your Chapter 7 bankruptcy in this guide on Utah bankruptcy exemptions.

Virginia Bankruptcy Exemptions are the laws that allow you to keep assets in a Chapter 7 The most common type of bankruptcy is a Chapter 7 bankruptcy, aka a liquidation

The homestead exemption – This allows for up to $60,000 in real property to be exempt from Chapter 7 proceedings. Real property can include a house, condo or mobile home, and a

If home equity exceeds the exemption, the bankruptcy trustee may sell the property, but the homeowner receives the exempted portion. In Chapter 7 bankruptcy, non Random YouTube Video No Association With This Website Texas a specific value Chapter 7 Bankruptcy Exemptions In fact, most Texans who file a Some states let filers use the federal bankruptcy exemptions instead of state exemptions. Learn about protecting property with federal bankruptcy exemptions.

Learn what property you can keep when filing Chapter 7 bankruptcy in Virginia using state exemptions, including your home, car, wages, and personal items. Exempt property them with is an essential concept in Chapter 7 bankruptcy. It refers to the assets that debtors can keep after filing for bankruptcy, protecting them from liquidation by the

Are you thinking about filing bankruptcy? Are you afraid that you’ll lose what you own if up to you file for bankruptcy? Fortunately, the Florida Constitution offers various bankruptcy

What Are the Georgia Bankruptcy Exemptions?

Table of Contents When filing for bankruptcy, it is important to consider first and foremost if you will file for a Chapter 13 or a Chapter 7 bankruptcy. A Chapter

In a Nutshell Alabama residents of at least two years filing Chapter 7 bankruptcy will need to use the state’s exemptions to protect their personal property during the case. The California bankruptcy exemptions tell you what property you may keep in a Chapter 7 bankruptcy, and they also help determine the amount When you file for bankruptcy under Chapter 7 or Chapter 13, you must complete a packet of forms and file them with the court. Schedule C: The Property You Claim as Exempt

There’s a common myth that filing bankruptcy means losing everything you own. In reality, most Chapter 7 filers keep all or most of their property because it’s protected by Bankruptcy exemptions protect property in both Chapter 7 and Chapter 13 bankruptcy, and determine whether you’ll keep, lose or need to pay to keep property.

As you can see, when you’re filing for Chapter 7 bankruptcy, the California bankruptcy exemptions can help you keep most of the property that you own. Chapter 7 Bankruptcy exemption laws allow bankruptcy debtors to protect property from creditors. Although filers use the same exemptions in Chapter 7 and Chapter 13 bankruptcy,

Find out how California bankruptcy exemptions protect property in Chapters 7 and 13 so you know what you can keep and possibly lose in a California bankruptcy. In a Nutshell If you’ve lived in Arkansas for at least two years and you’re filing Chapter 7, you can choose between the federal or state bankruptcy exemptions. Bankruptcy Property that is classified as exempt in a chapter 7 bankruptcy is property that you are allowed keep when the bankruptcy is over. Most property is only protected up to a specific value.

- What Made Club Penguin Island A Failure In My Opinion

- When Adding The Turbo Nas To Ad, Will The Access Authority Of

- When Do Girls Stop Growing Taller

- What Is Transgenderism? : Gender Identity: A Philosophical Challenge

- What Is The Top Speed Of An Electric Bike?

- When A Yellow Jacket Sting Leads To Cellulitis

- What Is The Best Resources To Learn English Grammar Online For

- Whatsapp, Was Tun, Wenn Das Smartphone Gestohlen Wird

- What Makes A Place Special? – The Value of Special Places

- What Is The Vin Number Year Chart? Vin Year Decoder

- What Is The Clinical Significance Of Low Serum Amylase? Systematic